About

Get the most from your Benefits and Budget

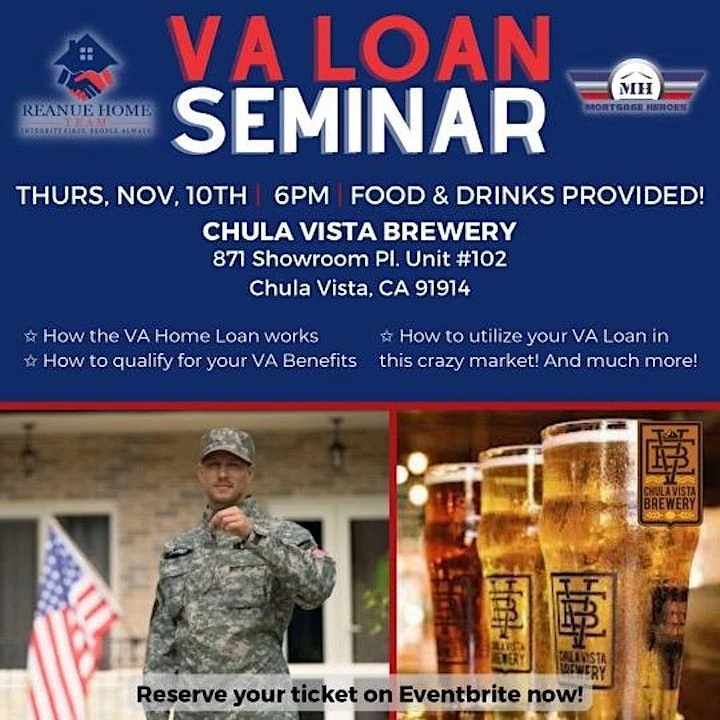

Find out why VA Loans are ideal for Veterans and military families.

- 0% Down

- Competitive Rates

- No PMI

- Easier to Qualify

VA home loans offer lifetime value. Your hard-earned benefit can be used over and over again. See how much you can save with the lowest average interest rate when compared to USDA, FHA, and Conventional Loans.

Military Mortgage Lending

Is your Home Base for all things home.

Restoring Your VA Loan Entitlement

Reinstating full VA loan entitlement necessitates sale documentation like the Closing Disclosure for lender application via the VA portal, usually tied to property sale.

Back-to-Back Loan Closings

When selling old and purchasing new homes simultaneously, veterans can streamline the restoration of their entitlement within a day, securing full buying power and minimizing uncertainties

Mortgage Payoff Quote

Your mortgage payoff amount is the amount needed to close the loan. This is slightly different from your remaining balance, as it includes accrued interest and other fees the lender might add. It’s important to note that a payoff quote has an expiration date, which is usually between 10 to 30 days.

Determining Home Equity

Home equity is the financial stake you have in your home. It’s the difference between what you currently owe on your mortgage and what your house is worth on the market. Equity also represents what you earn on your home when you sell it, minus the loan payoff and other sales-related expenses. important to note that a payoff quote has an expiration date, which is usually between 10 to 30 days. After that, you’ll need to get an updated one.

Short Sale

A short sale takes place when your lender lets you sell the home for less than what remains on the loan. This allows the lender to recoup at least some cash, while avoiding the hassle and expense of foreclosure.

Keep in mind that a short sale could negatively impact your ability to purchase a new home in the future. Additionally, you’ll forfeit your original down payment and your credit score will likely take a hit.

VA Cash-Out Refinance

A cash-out refinance creates a new loan on your home, allowing you to convert your home equity into cash. You can borrow up to 90% of your home’s value, as long as you meet specific VA guidelines which include at least six monthly payments on your current loan, and a refinance date at least 210 days after the first payment was due on your current loan.